Yield Curve Chart Bloomberg . Use the amber search bar to search by keyword (s) or browse the list. Monitor and chart sovereign bond yields, spreads,.

2-10 Treasury Curve Flirts Again With Inversion - Bloomberg from www.bloomberg.com

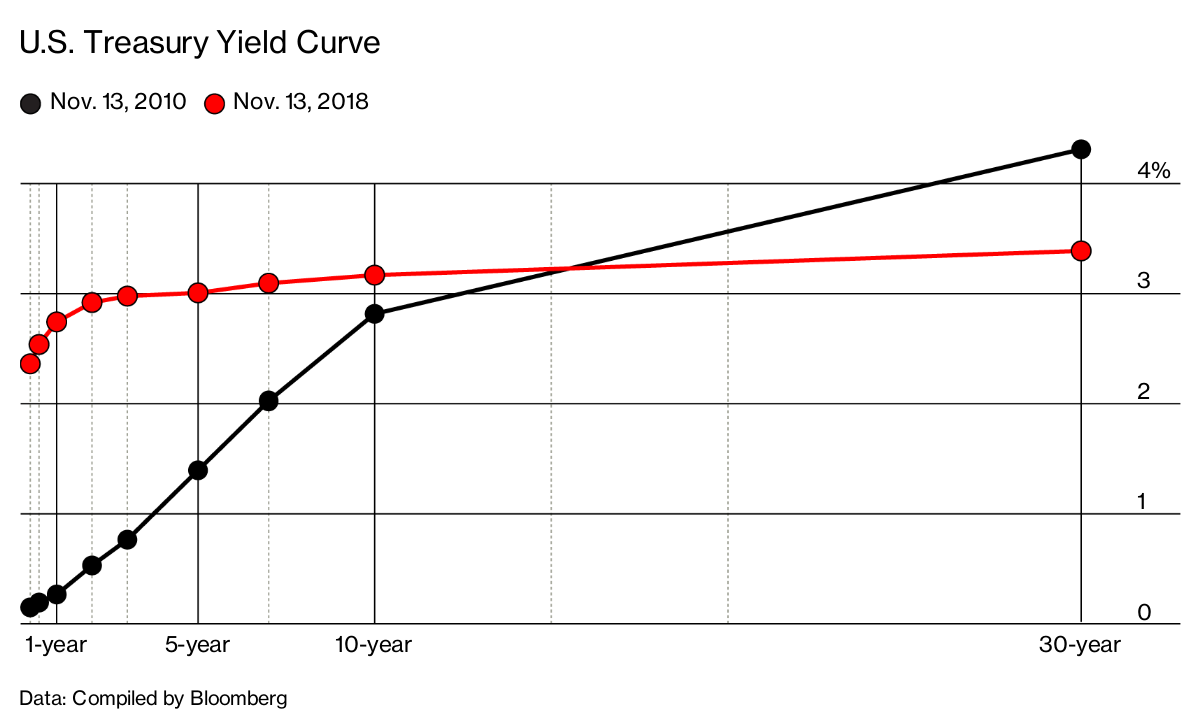

10 years vs 2 years bond spread is 21.3 bp. Yield curves are usually upward sloping asymptotically: Yields up to year 10 and callable yields thereafter.

2-10 Treasury Curve Flirts Again With Inversion - Bloomberg The two yield curves in the chart are from september 10, 2001 (yellow line) and from october 10, 2001 (green line). 19 jan 2022 18:15 gmt+0. The two yield curves in the chart are from september 10, 2001 (yellow line) and from october 10, 2001 (green line). Daily treasury yield curve rates are commonly referred to as constant maturity treasury rates, or cmts.

Source: www.ft.com A bloomberg professional services offering. The yield curve and why it matters. Yields up to year 10 and callable yields thereafter. Treasury bonds' times to maturity in cell a1 and u.s. Use the amber search bar to search by keyword (s) or browse the list.

Source: www.bloombergquint.com Yields are interpolated by the treasury from the daily yield curve. More specifically, the yield curve captures the perceived risks of bonds with various maturities to bond investors. Starting with the update on june 21, 2019, the treasury bond data used in calculating interest rate spreads is obtained directly from the u.s. How do i generate yield curves in bloomberg?.

Source: m.facebook.com How do i generate yield curves in bloomberg? The flags mark the beginning of a recession according to wikipedia. The vertical axis of a yield curve chart shows the yield, while the horizontal axis shows the maturity of the bonds (often converted into months in order to get a proper scaling on the chart). Click on the curves to add.

Source: www.bloombergquint.com Please enable it to continue. The philippines 10y government bond has a 4.835% yield. Yield curve spread trades, a.k.a curve trades1, provide market participants. Monitor and chart sovereign bond yields, spreads,. Type crvf and hit go for the curve finder.

Source: www.bloomberg.com How do i generate yield curves in bloomberg? Insert up to 4 curve ids. The two yield curves in the chart are from september 10, 2001 (yellow line) and from october 10, 2001 (green line). Yield curve in the u.s. The vertical axis of a yield curve chart shows the yield, while the horizontal axis shows the maturity of the.

Source: www.bloomberg.com Yield curve in the u.s. Increase the trail length slider to see how the yield curve developed over the preceding days. It looks like you're using internet explorer 11 or older. Type crvf and hit go for the curve finder. Monitor and chart sovereign bond yields, spreads, and historical performance on one screen,.

Source: www.bloomberg.com Allows to search for curves,. 19 jan 2022 6:15 gmt+0. 10 years vs 2 years bond spread is 21.3 bp. Bloomberg guide by topics getting started on bloomberg bloomberg keyboard. (total return) charts from bloomberg for all four stocks.

Source: www.youtube.com *bval snapshot of bloomberg valuation *tdh track msrb trade disclosure history *rchg track bond ratings changes *scn specific municipal bonds news *cacs material events for a security or issuer *cf search issuer filings *fa issuer financial analysis *yas bond prices based on yield curve spreads *ytc calculate yields to call *sf sinking fund. 19 jan 2022 18:15 gmt+0. According to.

Source: www.bloomberg.com Find information on government bonds yields, bond spreads, and interest rates. Learn how to use the bloomberg professional service. Yields are interpolated by the treasury from the daily yield curve. Insert up to 4 curve ids. More specifically, the yield curve captures the perceived risks of bonds with various maturities to bond investors.

Source: www.bloomberg.com Click on the curves to add them to your selected curves box. Yield curve in the u.s. The vertical axis of a yield curve chart shows the yield, while the horizontal axis shows the maturity of the bonds (often converted into months in order to get a proper scaling on the chart). This chart shows the relationship between interest rates.

Source: www.bloomberg.com The yield curve and why it matters. The japan 10y government bond has a 0.134% yield. (total return) charts from bloomberg for all four stocks. By our contributed sources in the form of a bar chart. Treasury bond's yields to maturity in cell b1.

Source: www.bloomberg.com Get updated data about global government bonds. I know you're looking at the yield curve covid what. Monitor and chart sovereign bond yields, spreads,. The japan credit rating is a+, according to standard & poor's agency. Our dynamic yield curve tool shows the rates for 3 months, 2 years, 5 years, 7 years, 10 years, 20 years, and 30 years.

Source: www.bloomberg.com Central bank rate is 2.00% (last modification in november 2020). Insert up to 4 curve ids. Bloomberg guide by topics getting started on bloomberg bloomberg keyboard. Bloomberg the company & its products. Monitor and chart sovereign bond yields, spreads, and historical performance on one screen,.

Source: www.bloomberg.com Use the amber search bar to search by keyword (s) or browse the list. Yield curves are usually upward sloping asymptotically: Starting with the update on june 21, 2019, the treasury bond data used in calculating interest rate spreads is obtained directly from the u.s. 5 steps to calculating yield curve. The japan 10y government bond has a 0.134% yield.

Source: www.bloomberg.com Click anywhere on the s&p 500 chart to see what the yield curve looked like at that point in time. Instructions and guide for world bonds and yields lab finc413 lab c 2014 paul laux and huiming zhang 1 introduction 1.1 overview in this lab, you will use bloomberg to explore some important issues about interest Government bond was 1.43.

Source: www.begintoinvest.com Percent, not seasonally adjusted frequency: 5 steps to calculating yield curve. This website works best with modern browsers such as the latest versions of chrome, firefox, safari, and edge. This curve assumes a normalized 5% coupon and is plotted as an offer side yield to worst. Using microsoft excel, enter u.s.

Source: www.researchgate.net Structured notes, municipal bonds, and preferred securities from the bloomberg database. Yield curves are usually upward sloping asymptotically: Our dynamic yield curve tool shows the rates for 3 months, 2 years, 5 years, 7 years, 10 years, 20 years, and 30 years. Click anywhere on the s&p 500 chart to see what the yield curve looked like at that point.

Source: www.bloomberg.com Government bond was 1.43 percent, while the yield. Find information on government bonds yields, bond spreads, and interest rates. By our contributed sources in the form of a bar chart. This chart shows the relationship between interest rates and stocks over time. The japan 10y government bond has a 0.134% yield.

Source: www.bloomberg.com I know you're looking at the yield curve covid what. Use the amber search bar to search by keyword (s) or browse the list. This curve assumes a normalized 5% coupon and is plotted as an offer side yield to worst. According to investopedia, the yield curve graphs the relationship between bond yields and bond maturity. Yields up to year.

Source: www.bloomberg.com (total return) charts from bloomberg for all four stocks. This curve assumes a normalized 5% coupon and is plotted as an offer side yield to worst. Structured notes, municipal bonds, and preferred securities from the bloomberg database. Monitor and chart sovereign bond yields, spreads, and historical performance on one screen,. Central bank rate is 2.00% (last modification in november 2020).