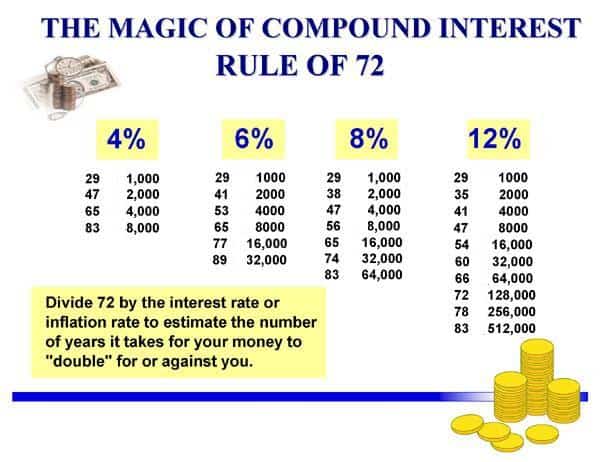

Rule Of 72 Chart . Quite useful in sales and making quick decisions where time is of the essence. Interest rate actual years rule of 72 1% 69.66 72.00 2% 35.00 36.00 3% 23.45 24.00 4% 17.67 18.00 5% 14.21 14.40 6% 11.90 12.00 7% 10.24 10.29 8% 9.01 9.00 9% 8.04.

The Rule Of 72 For Investing from thecollegeinvestor.com

72/5 = 14.40 which is very close to the actual value of 14.21. Interest rate required to double your investment: Rule of 72 = 12;

The Rule Of 72 For Investing Share your knowledge or experience. Although scientific calculators and spreadsheet programs have functions to find the accurate doubling time, the rules are useful for mental calculations and when only a basic calculator is available. The rule of 72, i texted him, says that if you divide 72 by the annual interest rate that you earn on an investment, you’ll learn approximately how long it will take for your investment to double in value. According to the rule of 72, it takes 72% yoy to double every year.

Source: www.2coolfishing.com The rule of 72 the most important and simple rule to financial success. (72 ÷ interest rate on invested funds) = number of years to double investment. Interest rate required to double your investment: Let’s say you have $100 in the bank. Rule of 72 = 12;

Source: exceluser.com Rule of 72 = 12; Family economics & financial education revised For example, to find out how long it will take to double your money givin an interest rate of 5%, simply divide. That number gives you the approximate number of years it will take for your investment to double. The rule of 72, i texted him, says that if.

Source: spreadsheetsolving.com Look at the chart from finance strategists—it shows how the rule of 72 plays out on an investment of $1,000 on a 5%, 8%, and 12% return over the course of 20 years. Several examples of rule of 72 outcomes are as follows: Let’s say you have $100 in the bank. According to the rule of 72, it takes 72%.

Source: www.intmath.com The actual equation is r x t = 72, where r is the interest rate and t is time, or periods of time, in months or years, from this equation the required interest rate and number of payment periods can be extracted. R x t = 72. For example, if you divide 72 by 6, you learn that it will.

Source: learn.financestrategists.com Rate of return years according to the rule of 72. The rule of 72 calculator also shows how the figures actually calculate over the time period if an amount is entered. T = 72 / r. It's an easy way to calculate just how long it's going to take for your money to double. Also, one is more likely to.

Source: www.bmogam.com The basic rule of 72 says the initial investment will double in 3.27 years. According to the rule of 72, it takes 72% yoy to double every year. When it comes to the accuracy of this rule, the best results are found at an 8% annual interest rate. Electrical calculators real estate calculators accounting calculators business calculators construction calculators Several.

Source: blog.americaschristiancu.com The rule of 72 calculator also shows how the figures actually calculate over the time period if an amount is entered. Just take the number 72 and divide it by the interest rate you hope to earn. The rule of 72 is an easy way to find out the approximate amount of time that it will take for your current.

Source: www.tflguide.com Well, for you to discover that time frame, all you need to know is what is the interest that the money is earning. The calculation is to divide 72 by the interest rate on the invested funds. Interest rate actual years rule of 72 1% 69.66 72.00 2% 35.00 36.00 3% 23.45 24.00 4% 17.67 18.00 5% 14.21 14.40 6%.

Source: www.pinterest.com How to calculate the rule of 72. 72/5 = 14.40 which is very close to the actual value of 14.21. It's an easy way to calculate just how long it's going to take for your money to double. Let’s say that money earns 10% (for simplicity.) well, now all you need to do is to apply. The calculation is to.

Source: thecollegeinvestor.com 72/5 = 14.40 which is very close to the actual value of 14.21. Don pistulka | posted at 5:15 pm , november. The basic rule of 72 says the initial investment will double in 3.27 years. Below is a mathematical representation of the rule of 72: Years to double your money = 72/interest rate.

Source: learn.financestrategists.com Look at the chart from finance strategists—it shows how the rule of 72 plays out on an investment of $1,000 on a 5%, 8%, and 12% return over the course of 20 years. Let’s say that money earns 10% (for simplicity.) well, now all you need to do is to apply. The rule of 72 can be used to calculate.

Source: www.intmath.com For instance, if your interest rate is 7%, it would take you 10.29 years for your money to double, and your equation. The rule of 72 is a simple formula used to estimate the length of time required to double an investment. The rule of 72 is an approximation. Rate of return years according to the rule of 72. Interest.

Source: spreadsheetsolving.com T = number of periods, r = interest rate as a percentage. Rate of return years according to the rule of 72. How to calculate the rule of 72. Quite useful in sales and making quick decisions where time is of the essence. Indeed, the rule of 72 is accompanied by the rule of 70 and the rule of 69,.

Source: corporatefinanceinstitute.com It's an easy way to calculate just how long it's going to take for your money to double. Interest rate required to double your investment: I recently learned that my son—who’s an avid amateur investor—had never heard of the rule of 72. Years to double your money = 72/interest rate. Just take the number 72 and divide it by the.

Source: ca.rbcwealthmanagement.com For instance, if your interest rate is 7%, it would take you 10.29 years for your money to double, and your equation. T = number of periods, r = interest rate as a percentage. Just take the number 72 and divide it by the interest rate you hope to earn. Rule of 72 i added the rule of 72, only.

Source: kharshit.github.io 72/5 = 14.40 which is very close to the actual value of 14.21. Let’s say that money earns 10% (for simplicity.) well, now all you need to do is to apply. Rule of 72 i added the rule of 72, only because it can come in handy to estimate the time it will take for a certain interest rate to.

Source: russellinvestments.com This table illustrates just how close the rule of 72 is to the actual doubling time. Let’s explain the rule of 72 with an example. Quite useful in sales and making quick decisions where time is of the essence. For example, if you divide 72 by 6, you learn that it will take about 12 years. Let’s say that money.

Source: learn.financestrategists.com Below is a mathematical representation of the rule of 72: The highlighted numbers show the time it takes for the original investment to essentially double, 14, 9, and 6 years respectively. Rate of return years according to the rule of 72. The following chart compares the results from the rule of 72 versus the actual number of years it will.

Source: www.myaccountingcourse.com Look at the chart from finance strategists—it shows how the rule of 72 plays out on an investment of $1,000 on a 5%, 8%, and 12% return over the course of 20 years. Rule of 72 = 12; Share your knowledge or experience. Let’s say that money earns 10% (for simplicity.) well, now all you need to do is to.

Source: www.how-to-fight-poverty.com (72 / 1 = 72.0 years) 2% interest rate. The rule number (e.g., 72) is divided by the interest percentage per period (usually years) to obtain the approximate number of periods required for doubling. So that's 2x each year. The rule of 72 is primarily used in off the cuff situations where an individual needs to make a quick calculation.