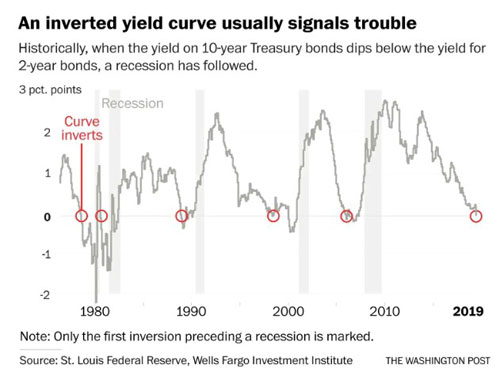

Inverted Yield Curve Chart . 75 figure 1 appears to indicate a strong correlation between yield curve. It’s a graph that could mean the difference between a thriving bull market or the downswing of a bear market.

The Great Yield Curve Inversion Of 2019 – Mother Jones from www.motherjones.com

If the patterns from the past hold true today, one can expect a generally lower interest rate environment in the months ahead. Since sharpcharts can use difference symbols, we can also chart a yield spread to show when the yield curve is inverted. Treasury yield curve” item under the “market” tab.

The Great Yield Curve Inversion Of 2019 – Mother Jones If the patterns from the past hold true today, one can expect a generally lower interest rate environment in the months ahead. This chart shows the relationship between interest rates and stocks over time. Inverted yield curves attract attention from the economic community not only because of their rare occurrence, but also due to their historical reliability as a leading indicator of recession. You can access the yield curve page by clicking the “u.s.

Source: www.kitco.com The bottom line is that the yield curve has inverted again. Since sharpcharts can use difference symbols, we can also chart a yield spread to show when the yield curve is inverted. An inverted yield curve, when us 10 year bond yield minus us 3 month bond yield has become negative, that has always preceded an economic recession, similar to.

Source: www.cnbc.com The light blue line is an adjusted. 65 rows an inverted yield curve is an interest rate environment in which long. (note that the lag between the inversion and a recession varies: The flags mark the beginning of a recession according to wikipedia. Such yield curves are harbingers of an economic recession.

Source: www.investopedia.com You can access the yield curve page by clicking the “u.s. An inverted yield curve, when us 10 year bond yield minus us 3 month bond yield has become negative, that has always preceded an economic recession, similar to prior march 2020 covid crash. Starting with the update on june 21, 2019, the treasury bond data used in calculating interest.

Source: today.duke.edu The curve was fully inverted in fall 2019 and is now correcting back to a more normal shape. 75 figure 1 appears to indicate a strong correlation between yield curve. Such yield curves are harbingers of an economic recession. As you can see from the chart below, it has moved into negative territory before every major recession in the last.

Source: www.dallasfed.org Starting with the update on june 21, 2019, the treasury bond data used in calculating interest rate spreads is obtained directly from the u.s. Inverted yield curve tracker 2021. This chart shows the yield curve (the difference between the 30 year treasury bond and 3 month treasury bill rates), in relation to the s&p 500. It’s a graph that could.

Source: www.investopedia.com You see, the yield curve spread is the most reliable lead indicator of future recessions we know. An inverted yield curve, when us 10 year bond yield minus us 3 month bond yield has become negative, that has always preceded an economic recession, similar to prior march 2020 covid crash. Animated yield curve interactive chart. The yield curve inverted at.

Source: en.swissquote.lu This chart shows the relationship between interest rates and stocks over time. A full yield curve, like the one you see above, charts the yields of bonds with maturities from one month to 30 years in the. Treasury yield curve” item under the “market” tab. Yield curve in the u.s. Watch this space to see if.

Source: ritholtz.com 75 figure 1 appears to indicate a strong correlation between yield curve. The light blue line is an adjusted. Yield curve refers to graph proving relationship between maturity length of bondssuch as one month, three months, one year, 5 years, twenty years, and so on. Inverted yield curves have historically been reliable predictors of impending recessions, which is why people.

Source: www.motherjones.com Yield curve in the u.s. The light blue line is an adjusted. This reminds us again of the kindleberger statement that an inverted yield curve has predicted 38 of the last three recessions. (note that the lag between the inversion and a recession varies: Yield curve refers to graph proving relationship between maturity length of bondssuch as one month, three.

Source: www.economist.com The bottom line is that the yield curve has inverted again. How does the yield curve work? Indeed, as the chart below shows, the gold prices rose on monday to their highest in more than two months. The us treasury updates the yield curve rates daily, and investors and economists use the data to infer the economy’s growth trajectory. It.

Source: www.marketwatch.com Average number of months before peak: Inverted yield curves have historically been reliable predictors of impending recessions, which is why people are paying so much attention to the yield curve now. The flags mark the beginning of a recession according to wikipedia. This fred graph effectively illustrates that every recession since 1957 has been preceded by a yield curve inversion..

Source: www.vox.com If the patterns from the past hold true today, one can expect a generally lower interest rate environment in the months ahead. The red line is the yield curve. (note that the lag between the inversion and a recession varies: The curve is inverted when the line drops below zero, so it. The bottom line is that the yield curve.

Source: www.britannica.com Inverted yield curve tracker 2021. This chart shows the relationship between interest rates and stocks over time. The curve is inverted when the line drops below zero, so it. Figure 2 shows a flat yield curve while figure 3 shows an inverted yield curve. Government bond was 1.43 percent, while the yield.

Source: www.reuters.com You can access the yield curve page by clicking the “u.s. The yield curve is a simple chart that plots us treasury bond interest rates (called yields) over time. And it’s terrifying for financial pundits all over the world. Inverted yield curves have historically been reliable predictors of impending recessions, which is why people are paying so much attention to.

Source: www.advisorperspectives.com It’s a graph that could mean the difference between a thriving bull market or the downswing of a bear market. You see, the yield curve spread is the most reliable lead indicator of future recessions we know. It should add to the fears of recession, which be a tailwind for the yellow metal in the near future. The first chart.

Source: www.independent.org 65 rows an inverted yield curve is an interest rate environment in which long. Yields are interpolated by the treasury from the daily par yield curve. And it’s terrifying for financial pundits all over the world. The red line is the yield curve. Percent, not seasonally adjusted frequency:

Source: www.cnbc.com An inverted yield curve, when us 10 year bond yield minus us 3 month bond yield has become negative, that has always preceded an economic recession, similar to prior march 2020 covid crash. The yield curve is a simple chart that plots us treasury bond interest rates (called yields) over time. Since 1988, there have been three cycles when the.

Source: www.inceconnect.co.za How does the yield curve work? Watch this space to see if. Increase the trail length slider to see how the yield curve developed over the preceding days. The article points out that most charts are showing nominal rates. The curve is inverted when the line drops below zero, so it.

Source: www.marketwatch.com Inverted yield curves have historically been reliable predictors of impending recessions, which is why people are paying so much attention to the yield curve now. We know that an inversion of the yield curve precedes a recession and bear market. The yield curve inverted at [a] and was followed by a sharp fall in the s&p 500. (note that the.

Source: www.investopedia.com The yield curve is a simple chart that plots us treasury bond interest rates (called yields) over time. As you can see from the chart below, it has moved into negative territory before every major recession in the last 45 years (shaded areas on the chart), including the pandemic panic in 2020. But look at the chart below highlighting the.